Welcome to Azasend’s Weekly Crypto Market Newsletter!

📈 BITCOIN & ALTCOIN PRICE SUMMARY (June 23 – June 29, 2025)

This past week, Bitcoin posted a strong bullish candle, fully erasing the previous week’s losses. Although it briefly broke below the $100,000 mark—triggering billions of dollars in liquidations from leveraged positions—the price quickly rebounded upon reaching a key psychological support zone.

This suggests the move may have been a classic liquidity sweep, targeting high-leverage positions with stop-losses near the round-number $100,000 level. Closing the week above $108,000 helped the bulls regain control, and overall sentiment has shifted more positively.

- Bitcoin closed the week at $108,385, up +7.33% compared to the previous week.

- Top 10 altcoins: SOL (+16.52%) and ETH (+12.24%) led the gains; TRX (+5.08%) and BNB (+6.34%) also performed well.

- Top 100 altcoins: PENGU (+67.09%) and SEI (+50.52%) surged impressively; KAIA (−8.22%) and PAXG (−3.70%) declined.

📢 EVENTS THAT COULD IMPACT PRICES

Global markets closely watched escalating tensions between Iran and Israel last week, as Iran launched missile attacks on Israeli territory. Surprisingly, market reaction defied expectations: Bitcoin rebounded sharply to $106,000 after briefly dipping below $100,000—despite the conflict still unfolding. When Trump later announced a temporary ceasefire between the two sides, BTC price moved sideways, likely because it had already surged and was nearing key resistance.

Meanwhile, institutional money keeps flowing into crypto. Funds like Metaplanet, Strategy, BlackRock, CardoneCapital, and ProCap are actively accumulating BTC and ETH as long-term strategic assets. New investment models combining crypto with real estate, AI, and high-tech sectors are forming a more diversified, flexible, and pragmatic ecosystem than ever before.

On the regulatory front, the U.S., Canada, and Hong Kong are accelerating crypto legislation—from recognizing digital assets as collateral and launching stablecoins, to protecting private wallet ownership. These developments not only provide a stronger legal foundation but also mark the dawn of a new era where digital assets hold a clear position in the global financial structure.

💰 Institutional Investment & Large Capital Inflows

- 🟢 Metaplanet bought more BTC, bringing its total to 12,345 BTC, eliminated debt by issuing new shares, and plans to invest $5B into its U.S. subsidiary.

- 🟢 Strategy added 245 BTC, now holding 592,345 BTC at an average cost of $70,681.

- 🟢 ProCapBTC acquired another 1,208 BTC after merging with Columbus Circle Capital, total now 4,932 BTC.

- 🟢 CardoneCapital, blending real estate and BTC, bought 1,000 BTC, planning to accumulate 3,000 more this year.

- 🟢 BlackRock’s $IBIT ETF surpassed the S&P 500 ETFs in 2025 fund inflows, ranking among the top 5 over the past 3 years.

- 🟢 ECD Automotive raised $500M to acquire BTC and expand its luxury market share.

- 🟢 Bitwise filed for in-kind ETFs for Dogecoin and Aptos, signaling progress with the SEC.

- 🟢 Cel AI (UK) raised $10.3M to buy BTC.

- 🟢 BTCT (Canada) raised $92M to acquire BTC, now officially trading on TSX Venture Exchange.

- 🟢 Belgravia Hartford (Canada) raised 10M CAD to accumulate more BTC.

- 🟢 SharpLink Gaming bought an additional $30M of ETH, total holdings now 188,000 ETH.

- 🟢 Kraken launched the INK token and airdrop on Layer 2 Ink, aiming to compete with Coinbase’s Base.

- 🟢 ProCap Financial plans to raise $1B to hold BTC as a strategic asset.

- 🟢 Build & Build Corporation preparing to acquire $100M worth of BNB, the first time a listed company holds BNB as a reserve asset.

- 🟢 Binance continues NEWT and SAHARA airdrops—two AI & auto-trade projects—drawing capital to new ventures.

🗣 Notable Remarks & Forecasts

- 🟢 Fed Governors Bowman, Waller, and Powell signaled openness to rate cuts if inflation is controlled.

- 🟢 ECB President Nagel remained cautious about rate adjustments amid global uncertainties.

- 🟢 Trump: “Crypto is an industry the U.S. must lead,” proposed cutting interest rates to 1% and replacing Fed Chair Powell.

- 🟢 Chamath Palihapitiya predicts BTC could replace gold due to halving and ETF effects.

- 🟢 Adam Livingston: Companies accumulating BTC are redefining 21st-century “value.”

- 🟢 Senator Lummis: BTC should be a national strategic reserve asset.

- 🟢 BlackRock CEO: BTC is the new global currency, as appealing as gold.

- 🟢 Philippe Laffont: “Every morning I ask myself why I haven’t bought BTC yet.”

⚖️ Policy & Regulation

- 🟢 Texas and Arizona officially enacted laws establishing public Bitcoin reserves.

- 🟢 U.S. FHFA requires Fannie Mae and Freddie Mac to treat crypto as valid mortgage collateral.

- 🟢 GENIUS Act on stablecoins submitted to the U.S. House, awaiting vote.

- 🟢 U.S. Senate and White House agreed to expedite CLARITY and GENIUS crypto bills.

- 🟢 FHFA exploring how crypto can be held while still qualifying for mortgages—an important shift for digital assets.

- 🟢 U.S. Senate Banking Committee issued crypto regulatory principles, emphasizing self-custody rights.

- 🟢 Hong Kong to allow licensed stablecoin issuance starting August 1 and expanding tokenization framework.

- 🟢 Turkey issued new AML rules for crypto, restricting stablecoin transfers.

- 🟢 U.S. Fed removed “reputation risk” from bank oversight, paving way for crypto partnerships.

- 🟢 COIN Bill submitted to Congress to prevent government officials from manipulating crypto markets for personal gain.

🌐 Macro & Intermarket Update

- 🔴 U.S. airstrikes hit Iranian nuclear facilities, sparking reciprocal attacks between Iran and Israel.

- 🔴 Iran launched missiles at U.S. base in Qatar—market reaction muted as oil supply unaffected.

- 🟢 Trump announced a temporary ceasefire between Israel and Iran, reducing tensions.

- 🔴 Oil futures plunged to ~$65 as Iran didn’t block the Strait of Hormuz, easing supply pressure.

- 🔴 U.S. Q1 GDP revised down to -0.5%, below expectations, signaling weaker-than-expected economy.

- 🟢 U.S. jobless claims fell, suggesting labor market remains steady.

- 🟢 PCE and Core PCE inflation data met expectations, supporting a potential rate cut.

- 🟢 Nasdaq and S&P 500 hit new highs, reflecting optimism around policy easing.

- 🔴 China’s industrial profits dropped sharply, signaling ineffective economic stimulus.

- 🔴 Trump ended trade talks with Canada after it imposed a digital tax on U.S. Big Tech firms.

- 🟢 U.S.–China agreed on new trade framework for rare earths and tech.

- 🟢 Post-2024 elections, most of the U.S. Congress supports Bitcoin, creating a more favorable regulatory environment for digital assets.

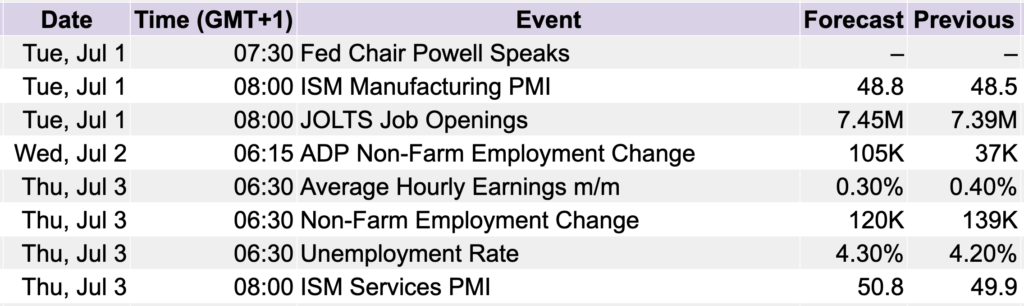

🗓️ KEY ECONOMIC EVENTS THIS WEEK

This week, U.S. markets remain in focus with crucial employment data releases: Non-Farm Payrolls, unemployment rate, and average earnings—all of which will help shape interest rate expectations. Additionally, Fed Chair Powell’s speech early in the week will be closely watched for further monetary policy signals.

⏰ Note: These data releases often trigger high volatility. If you’re trading short-term, pay special attention to managing your positions during these windows.

⛔ Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Always assess your own position and risk tolerance before making decisions.

🎯 INVESTMENT PRINCIPLES

- Don’t FOMO: Stay calm and avoid following the crowd.

- Don’t ALL IN: Diversify your capital and manage risks.

- Don’t BORROW: Only trade with money you can afford to lose.

- Don’t BE PASSIVE: Keep learning, researching, and staying updated.

- Don’t ask “BUY OR SELL?”: No one knows your position better than you.

“A short-term trader on the 1H timeframe may take profits within a day, while a long-term investor on the weekly chart may hold for a year. Each person has different entry points, risk thresholds, timeframes, and goals.”

👉 Don’t forget to catch next week’s Azasend newsletter for the latest developments in the crypto market!

Best regards,

The Azasend Team